Extended Reality Market Size, Share and Trends 2030

Extended Reality Market by Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR), Head-mounted Displays, Head-up Displays, Sensors, Controllers and Processors, Displays, Gaming, Retail, E-commerce and E-learning - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

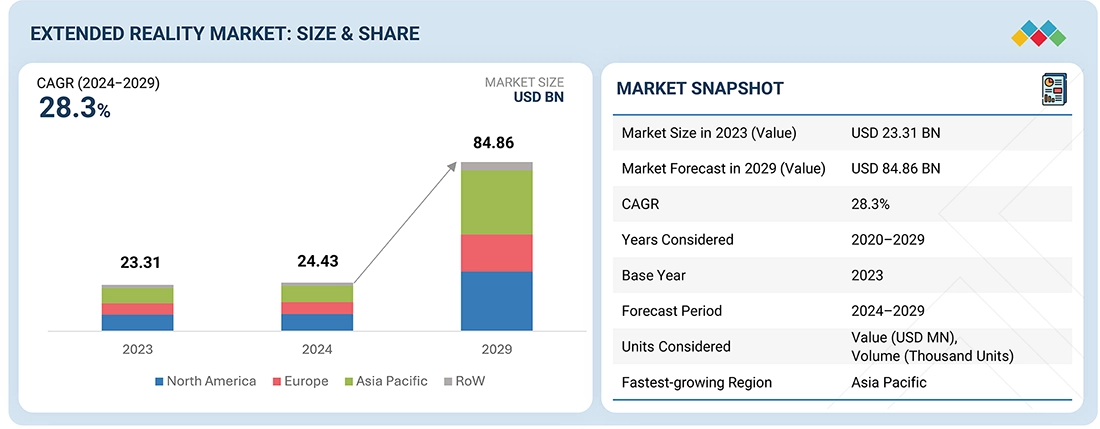

The extended reality market is projected to reach USD 84.86 billion by 2029 from USD 24.43 billion in 2024, at a CAGR of 28.3% from 2024 to 2029. The global Extended Reality market is driven by rapid digital transformation across industries, growing enterprise adoption of immersive technologies for training, design, and remote collaboration, and continuous advancements in XR hardware, software, and AI integration that enhance user experience and scalability.

KEY TAKEAWAYS

-

By RegionThe North America extended reality market dominated with a market share of 35.6% revenue share in 2023.

-

By OfferingBy offering, the hardware segment is expected to register the highest CAGR of 32.4%.

-

By TechnologyBy technology, the AR segment is expected to dominate the market from 2024 to 2029.

-

By ApplicationBy application, the consumer segment is dominating the extended reality market

-

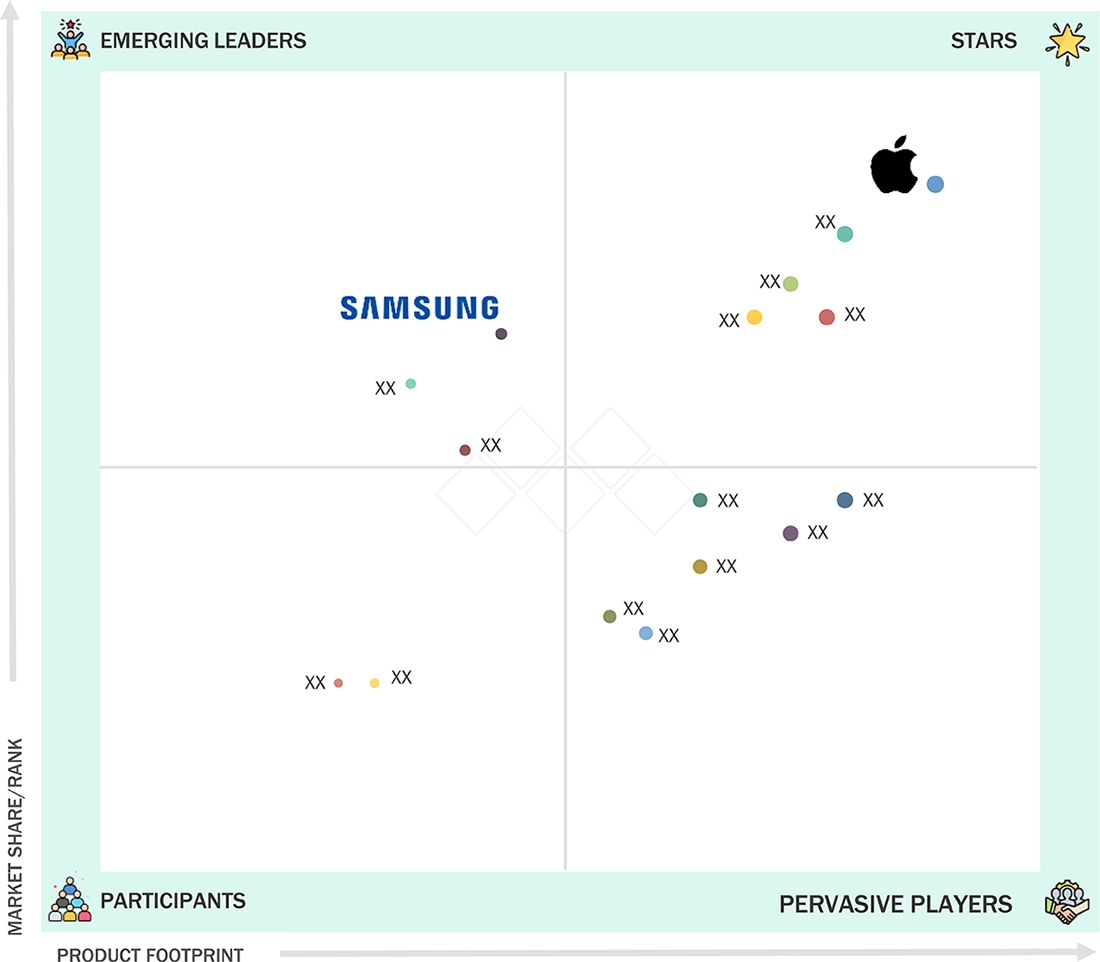

Competitive LandscapeMeta, Apple, and Microsoft, among others, were identified as Star players in the extended reality market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

-

Competitive LandscapeUltraleap, Lynx, and Magic Leap have distinguished themselves among startups and mid-sized players in the Extended Reality market through their strong technology portfolios, enterprise-focused solutions, and clear go-to-market strategies.

The extended reality market is gaining strong momentum as enterprises seek more immersive, efficient, and scalable ways to train workforces, design products, and enable remote collaboration. Growing adoption across manufacturing, healthcare, education, retail, and enterprise operations is driven by the need for improved productivity, reduced operational costs, and enhanced user engagement. Advancements in XR hardware, spatial computing, cloud connectivity, and AI-driven content creation are further improving realism, accessibility, and deployment at scale, accelerating overall market adoption.

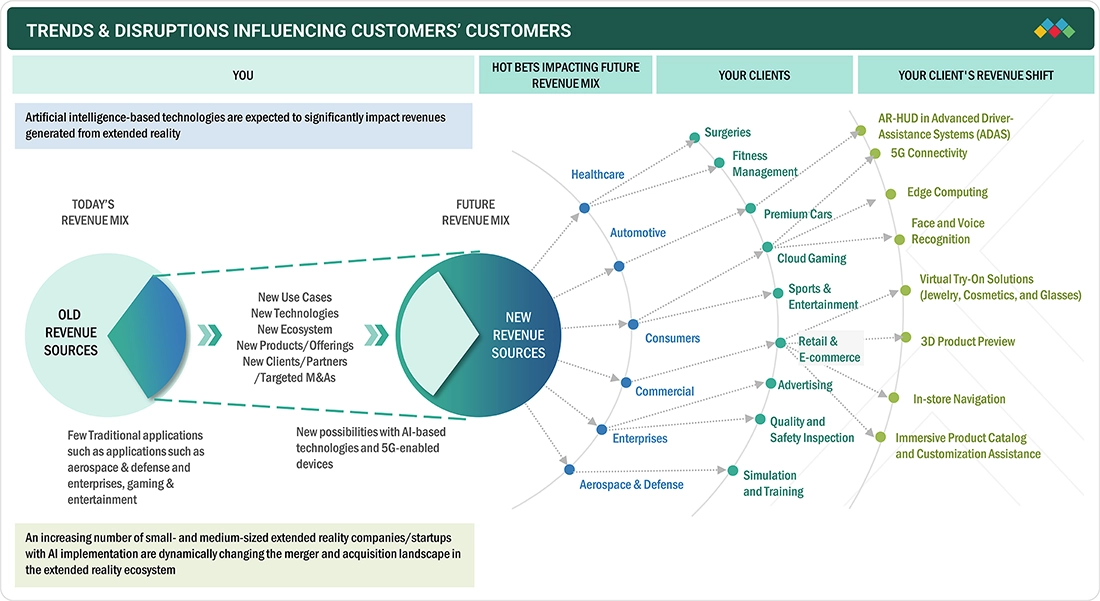

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Extended Reality market is undergoing rapid transformation driven by AI-enabled technologies that are reshaping revenue models and use cases. XR is shifting from traditional gaming and entertainment toward high-value applications in healthcare, automotive, retail, and enterprise operations. AI-powered vision, spatial computing, and real-time analytics are enhancing realism, interactivity, and decision-making. Adoption is accelerating across training, quality inspection, virtual try-ons, and immersive customer experiences. The convergence of XR with 5G and edge computing is improving scalability and performance. Increasing participation from AI-focused startups is intensifying innovation and competitive disruption.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Growing use of XR in education, industrial training, healthcare and entertainment and gaming

-

• Availability of affordable VR devices.

Level

-

•High installation and maintenance costs of XR devices

-

•Rapid Technology changes in extended reality devices

Level

-

•Expanding use of XR in the automotive, aerospace and defence sectors

-

•Ongoing advancements in 5G technology

Level

-

•Protecting consumer privacy

-

•Issues with display delays and limited field of view

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing use of XR in education, industrial training, healthcare and entertainment and gaming

XR provides immersive learning experiences that enhance engagement and retention. It is being used for surgical simulations, patient treatment, and medical training. Also, XR technology is in growing demand in gaming and entertainment sector. As more immersive games and experiences are developed, the popularity of XR in entertainment will continue to grow. Overall, these factors contribute to the rising adoption and integration of XR technologies across multiple sectors in the coming years.

Restraint: High installation and maintenance costs of XR devices

As XR devices continue to evolve with better hardware features such as higher-resolution displays, enhanced spatial audio, and advanced tracking systems, their production costs will also increase. The XR technology will become more sophisticated and widespread, the costs associated with installation and maintenance likely to increase in future.

Opportunity: Expanding use of XR in the automotive, aerospace and defence sectors.

As industry prioritize technological innovation and operational efficiency, the expanding use of XR in automotive, aerospace, and defense sectors will likely experience robust growth. The demand for better design processes, immersive training, and improved customer experiences will continue to drive XR adoption across these industries.

Challenge: Protecting consumer privacy

XR devices, such as VR headsets and AR glasses, are increasingly collecting vast amounts of personal data, including biometrics (eye movement, facial expressions), location, and behavior patterns. As these technologies evolve, they will gather even more detailed information to create immersive experiences, making privacy concerns more prominent.

EXTENDED REALITY MARKET SIZE, SHARE AND TRENDS 2030: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Mixed Reality (MR) headsets used for remote assistance, guided maintenance, and training in manufacturing and industrial operations. | Reduces downtime, improves first-time fix rates, lowers training costs, and enhances workforce productivity. |

|

Industrial XR solutions for digital twins, factory layout planning, and immersive engineering design reviews. | Accelerates design cycles, reduces errors before deployment, and improves collaboration across engineering teams. |

|

VR-based safety training and skill simulation for manufacturing, logistics, and enterprise environments. | Enhances learning retention, improves worker safety, and enables scalable training programs. |

|

XR development platform used for automotive design visualization, virtual prototyping, and HMI testing. | Reduces physical prototyping costs, speeds up design validation, and improves product quality. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Extended Reality ecosystem comprises several key components, including hardware and platform manufacturers, software and service providers, and diverse end-user verticals. Manufacturers develop XR devices, optics, sensors, and computing platforms such as headsets and smart glasses that enable immersive experiences across consumer and enterprise environments. Service and software providers deliver XR content creation, application development, system integration, cloud platforms, and ongoing support to ensure scalable and effective deployment. End-user verticals—including healthcare, manufacturing, retail, automotive, education, and defense—adopt XR solutions to enhance training, design, operations, customer engagement, and decision-making. Together, these stakeholders form an interconnected ecosystem driving innovation, adoption, and commercialization of Extended Reality globally.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Extended Reality Market, By Offering

As of 2024, the software segment holds the largest market share. This dominance is driven by the widespread adoption of XR platforms, development tools, and content management systems that enable enterprises to design, deploy, and scale immersive applications across industries. Unlike hardware, XR software supports continuous updates, customization, and cross-device compatibility, making it critical for enterprise workflows such as training, simulation, remote collaboration, and digital twin visualization. Advancements in AI-enabled content creation, cloud-based XR platforms, and real-time rendering have further strengthened software adoption, reinforcing its leading position in the market.

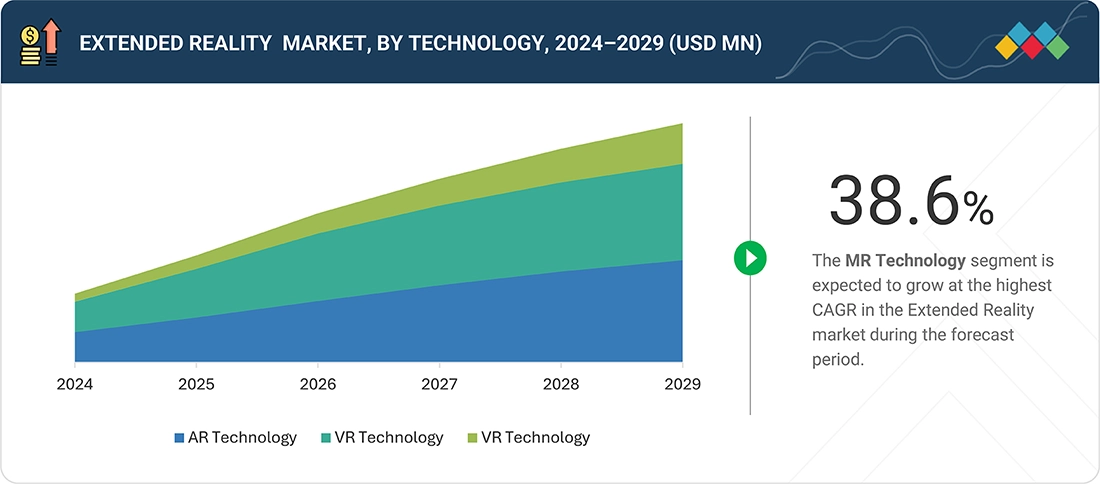

Extended Reality Market, By Technology

By technology, the MR segment is projected to grow at the highest CAGR during the forecast period. This accelerated growth is driven by MR’s ability to seamlessly blend physical and digital environments, enabling more interactive and context-aware experiences than standalone AR or VR. Enterprises are increasingly adopting MR for complex use cases such as advanced training, remote assistance, digital twins, and collaborative design, where real-world interaction is critical. Improvements in spatial computing, sensor fusion, and enterprise-grade MR headsets are further expanding MR adoption, supporting its strong growth outlook.

Extended Reality Market, By Device Type

In 2024, the VR Devices segment accounts for the largest share. This leadership is supported by the widespread availability of cost-effective VR headsets and their strong adoption across gaming, entertainment, training, and simulation applications. VR devices offer fully immersive experiences with mature hardware ecosystems, making them easier to deploy at scale compared to other XR devices. Continuous improvements in display resolution, processing performance, and content ecosystems have further reinforced the dominance of VR devices in the market.

Extended Reality Market, By Application

By application, the consumer segment is projected to account for the largest share during the forecast period. This dominance is driven by strong adoption of XR technologies in gaming, entertainment, social interaction, fitness, and immersive media experiences. Growing availability of affordable VR and AR devices, expanding content libraries, and increasing integration of XR features into smartphones and consumer electronics are accelerating consumer adoption. Continuous innovation in immersive content, cloud gaming, and social XR platforms further supports the segment’s leading market share.

REGION

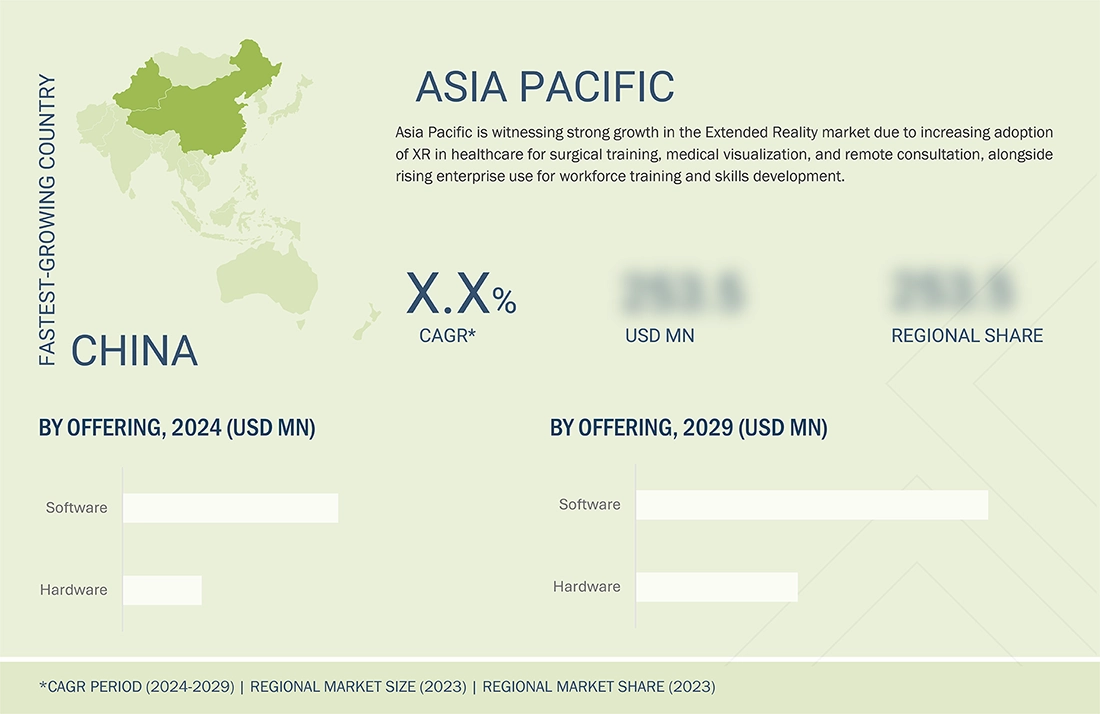

Asia Pacific to be fastest-growing region in global extended reality market during forecast period

Asia Pacific is projected to witness the highest growth in the extended reality market during the forecast period. This rapid growth is driven by increasing digitalization, rising investments in smart manufacturing and digital education, and expanding adoption of XR technologies across consumer and enterprise applications. Strong presence of electronics manufacturing hubs, growing gaming and entertainment markets, and supportive government initiatives for emerging technologies in countries such as China, Japan, South Korea, and India are further accelerating regional market growth.

EXTENDED REALITY MARKET SIZE, SHARE AND TRENDS 2030: COMPANY EVALUATION MATRIX

In the Extended Reality market matrix, Apple is positioned as a star player, driven by its strong ecosystem integration, premium hardware capabilities, and long-term vision for spatial computing through devices such as Vision Pro. Apple’s control over hardware, software, and content platforms enables seamless, high-quality immersive experiences across consumer and enterprise use cases, reinforcing its leadership trajectory. Samsung, positioned as an emerging leader, is strengthening its presence through advanced display technologies, partnerships within the Android and XR ecosystem, and growing investments in next-generation head-mounted devices. While Apple continues to set the benchmark through ecosystem-driven innovation and premium positioning, Samsung is steadily advancing toward leadership by leveraging scale, component expertise, and collaborative XR strategies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Meta Platform Inc. (US)

- Microsoft (US)

- Sony Group Corp (Japan)

- Apple (US)

- Google (US)

- HTC Corp (Taiwan)

- PTC Inc. (US)

- Seiko Epson Corporation (Japan)

- Qualcomm Technologies Inc. (US)

- Samsung Electronics Co. Ltd (South Korea)

- Lenovo Group Ltd. (China)

- Panasonic Holdings Corp. (Japan)

- Eon Reality (US)

- Continental AG (Germany)

- Visteon Corporation (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 23.31 Billion |

| Market Forecast in 2029 (Value) | USD 84.86 Billion |

| Growth Rate | CAGR of 28.3% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Noth America, Europe, Asia Pacific, and RoW |

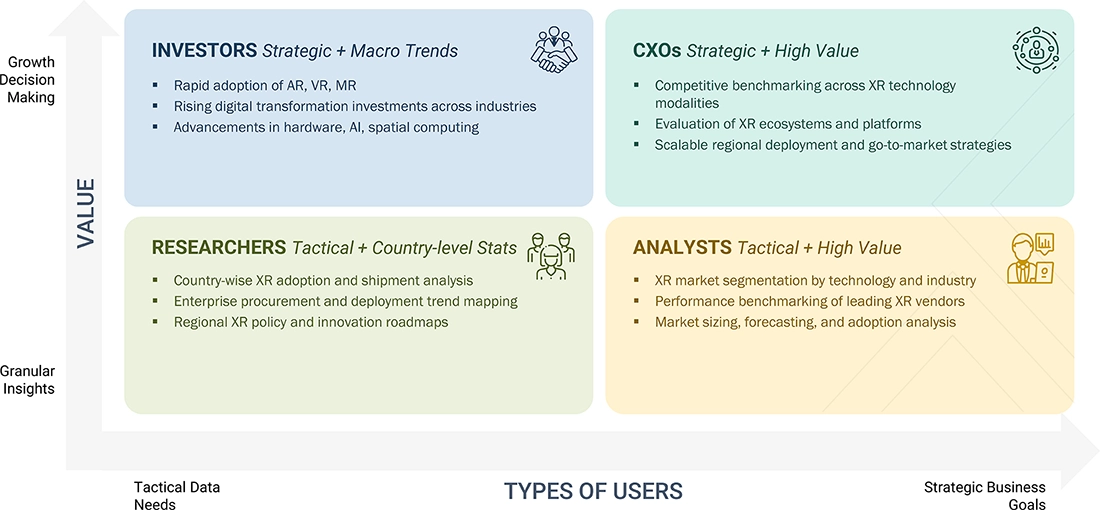

WHAT IS IN IT FOR YOU: EXTENDED REALITY MARKET SIZE, SHARE AND TRENDS 2030 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Oil & Gas Pipeline Operator |

|

|

| Aerospace OEM |

|

|

| Industrial Manufacturing Leader |

|

|

RECENT DEVELOPMENTS

- September 2024 : Meta added a new AI feature to Ray-Ban Meta Glasses to help users remember things such as parking locations. They also translate speech in real time, help the user experience the world, capture movements, and more, completely hands-free.

- September 2024 : Meta launched the new Meta Quest 3S headset, which offers the same mixed reality features and fast performance as Meta Quest 3, but at a lower price.

- August 2024 : Microsoft is reportedly planning to launch its own portable virtual reality (VR) headset next year. Microsoft has signed a supply contract with Samsung Display to receive hundreds of thousands of micro-OLED panels for the mixed reality headset. The VR headset will reportedly be geared towards gaming and entertainment, rather than focusing on the metaverse.

- February 2023 : Sony Group Corporation launched the PlayStation VR2 device, and the PlayStation VR2 Sense controller charging docking station which offers an advanced and captivating interactive play experience. The PS VR2 has a feature that allows headset feedback, eye tracking, spatial audio, and the adaptive triggers and rumble functions found in the controllers in the PS VR2 Sense.

- March 2023 : Meta declared its plan to launch its first AR glasses by 2027. Internal testing for these glasses is expected to begin in 2024.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

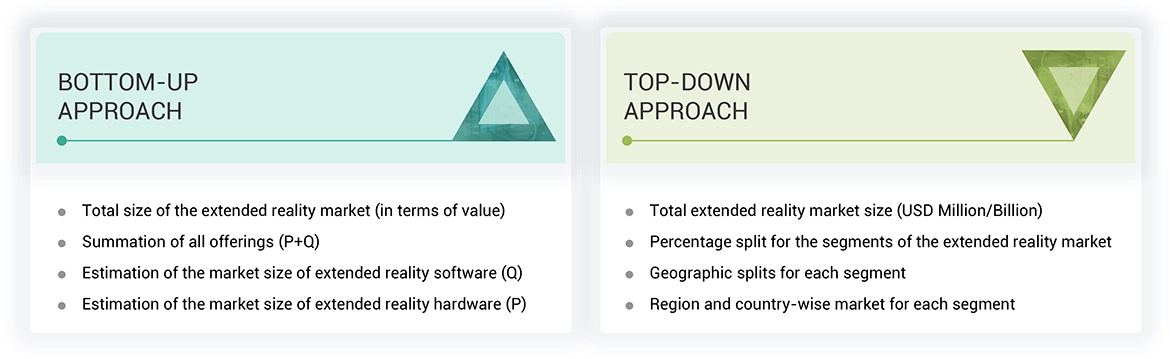

The research study involved 4 major activities in estimating the size of the extended reality market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the extended reality market report, the global market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage share splits and breakdowns have been determined using secondary sources and verified through primary sources.

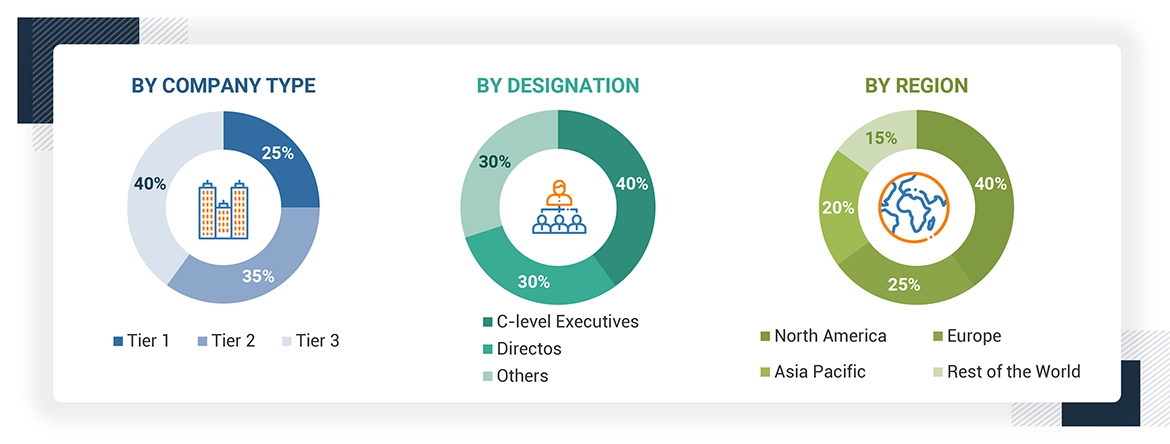

Primary Research

Extensive primary research has been conducted after understanding the extended reality market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the extended reality and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

The bottom-up procedure has been employed to arrive at the overall size of the extended reality market.

- Identifying various extended reality devices and software provided or expected to be offered by players in the value chain

- Tracking the major manufacturers and providers of extended reality devices and related software for different regions

- Estimating the extended reality market for devices and software in the respective countries of each region

- Tracking the ongoing and upcoming product launches and different inorganic strategies such as acquisitions, partnerships, and collaborations

- Forecasting the extended reality market in each region based on trade data and GDP analysis

- Conducting multiple discussions with key opinion leaders to understand the types of devices and software deployed by extended reality players and analyzing the break-up of the scope of work carried out by each major company

- Arriving at the market estimates by analyzing the revenues generated by extended reality manufacturers and software providers based in their locations (countries) and then combining the shares to get the market estimate for each region

- Verifying and crosschecking the estimates at every level by discussing with key opinion leaders, including CEOs, directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, and white papers

The top-down approach has been used to estimate and validate the total size of the extended reality market.

- Focusing, initially, on the top-line investments and spending in the ecosystems of various industries. Tracking further splits based on product launches, advancements in extended reality technologies, and extended reality devices and software used for various industrial applications, and developments in the key market areas

- Representing and developing the information related to market revenue offered by key hardware and software providers

- Carrying out multiple on-field discussions with key opinion leaders across each major company involved in the development of hardware and software components pertaining to extended reality

- Estimating the geographic split using secondary sources based on factors such as the number of players in a specific country and region, types of products and types of software implemented.

Extended Reality Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall extended reality market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Extended Reality (XR) is an umbrella term that includes immersive technologies like Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR). These technologies serve to enhance the user experience by combining the physical and digital elements. Augmented reality (AR) captures a user’s view of reality and enhances it with virtual images or sounds. VR develops a live fictitious environment that users can fully immerse themselves in. MR integrates the real world and virtual worlds creating an interactive environment comprised of both the real and virtual worlds. Extended reality systems function with sophisticated devices like head mounted displays (HMD) units, smart goggles or in some cases even handheld devices and software systems, content development equipment and other elements. The incorporation of innovations, such as AI technology, 5G and motion sensors makes it possible to create innovative and realistic experiences for the end user.

The market for extended reality spans across multiple sectors such as games and entertainment, healthcare, education, retail, automotive, and industrial training, among others. It serves for various purposes including training and simulation, teamwork done through the internet, going on virtual tours, playing computer games, surgeries, etc. This shifts the paradigm on the way people perceive and use technology, while it is as well embraced by businesses for the purpose of enhancing productivity, developing customer relationships and optimizing processes.

Key Stakeholders

- Raw Material and Component Suppliers

- OEMs

- Display Manufactures

- Third-party Service Providers

- Distributors and Resellers

- Service Providers

- Regulatory Bodies

- Research and Development Institutes

- End Users

Report Objectives

- To define, describe, segment, and forecast the extended reality market size by technology, offering, and application in terms of value

- To define, describe, segment, and forecast the extended reality market size by device type in terms of value and volume

- To provide qualitative information about different extended reality devices and the applications of extended reality solutions in different enterprises

- To describe and forecast the extended reality market size in four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide details about the value chain of the extended reality market and provide detailed information regarding Porter's five forces, technology trends, product pricing, trade, use cases, and import and export trends pertaining to the extended reality market

- To analyze opportunities in the market for stakeholders, along with a detailed competitive landscape of the extended reality market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market share and core competencies, along with the competitive leadership mapping chart

- To analyze the competitive developments such as product launches, partnerships, collaborations, contracts, agreements, joint ventures, expansions, and acquisitions in the extended reality market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Extended Reality Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Extended Reality Market